Everybody had the fantasy of predicting the stock market. We investigated the subject in Are stocks predictable?. In short, they are not, at least the prices. The next step would be to go from prices to volatility measures. The reason is that one can use the volatility to properly price stock options using the Black-Scholes model. Wikipedia says that the formula has only one parameter that cannot be directly observed in the market: the average future volatility of the underlying asset. Therefore, the question is, can one predict that volatility?

In an unexptected twist of the action, we leave that as an exercise for the reader. Be sure to share your results. But there is something else to look at.

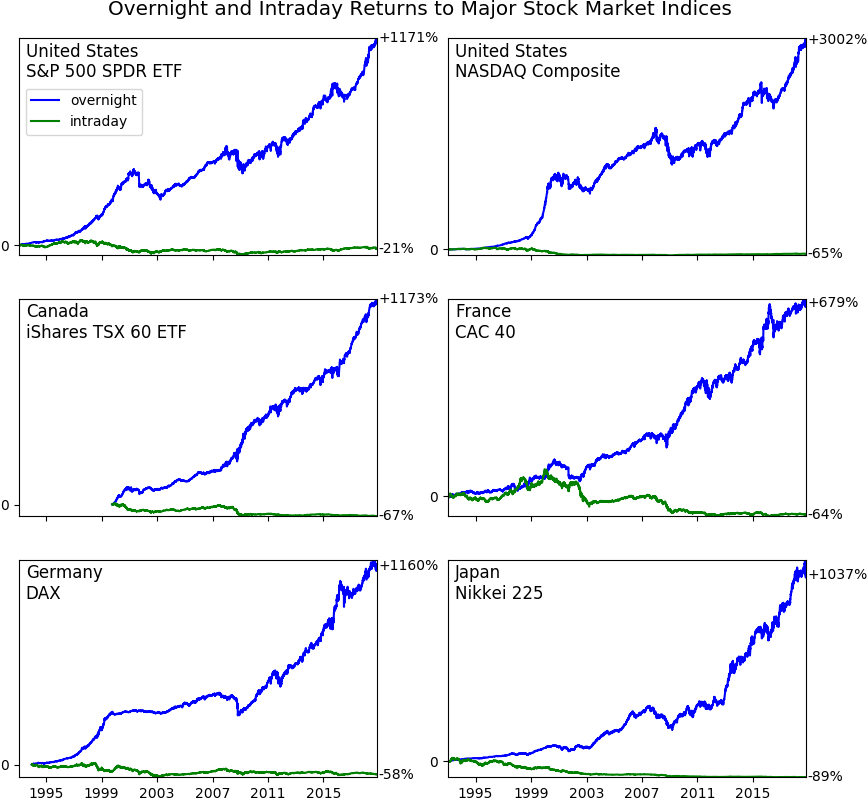

Overnight vs intraday returns

Apparently, the major stock markets only grow during non-trading hours. An interesting regularity, isn’t it?

Image credit: Bruce Knuteson’s site

Just in case you’re wondering how prices can change while the market is closed: people still place orders during that time and these orders are used to determine the opening price.

Here’s an abstract from the 2008 “Day and Night” paper by Cliff, Cooper and Gulen [PDF]:

We use transaction-level data and decompose the US equity premium into day (open to close) and night (close to open) returns. We document the striking result that the US equity premium over the last decade is solely due to overnight returns; the returns during the night are strongly positive, and returns during the day are close to zero and sometimes negative.

This day and night effect holds for individual stocks, equity indexes, and futures contracts on equity indexes and is robust across the NYSE and Nasdaq exchanges. Night returns are consistently higher than day returns across days of the week, days of the month, and months of the year. The effect is driven in part by high opening prices which subsequently decline in the first hour of trading.

Here’s another (redacted) abstract from Night Trading: Lower Risk But Higher Returns? by Marie-Eve Lachance, 2015:

Overnight returns tend to exceed their intraday counterparts, and the paper first reconciles these patterns by introducing a model that factors in recurring biases. This model identifies one fifth of stocks as having positive and statistically significant overnight biases. Investing overnight in these stocks in the next year yields twice the market’s return for a third of the market beta. Results have also implications for daytime investors as these stocks average negative returns intraday.

It looks like the topic attracted some more attention in 2018. For example, New York Times covered this in The Stock Market Works by Day, but It Loves the Night.

To recap, intraday trading returns tend to be around zero, while night gains, from market close to next day open, are consistently positive. The question is, why?

A possible explanation

A paper by Bruce Knuteson, How to Increase Global Wealth Inequality for Fun and Profit, offers an answer. It stipulates that the pattern of returns is a result of a large player, or players, executing a strategy that we call “hold an pump”. The paper refers to it as “the Strategy”. Its goal is to increase prices of selected stocks that the fund holds.

The Strategy is very simple: construct a large, suitably leveraged, market-neutral equity portfolio and then systematically expand it in the morning and contract it in the afternoon, day after day.

The Strategy works because your trading will, on average, move prices in a direction that nets you mark-to-market gains. Bid-ask spreads are wider and depths are thinner near market open than near market close, so aggressive trades early in the trading day move prices more than equally sized aggressive trades later in the day.

One needs quite a lot of money to move prices. Buying high and selling low results in negative cash flow day in, day out, so one would also need to hold a lot of a given stock to profit from price increases. The author suggests that the Strategy is available to institutions with roughly one billion dollars of available capital.

However, there is no other evidence for the use of the strategy than the amazing pattern of intraday/overnight returns.

Is there another explanation?

A sceptic might say that close to open return is high because all fundamental company and macro news are released before open or after close. The news are not always good, though. To this, the sceptic would reply that most firms and events match expectations, resolve uncertainties and generate positive returns.

Cliff, Cooper and Gulen investigated this. They concluded that

while there is a tendency in recent years for managers to release positive earnings information after the market closes, it does not explain the day and night effect.

They also look at some other possible explanations and find that

the models can explain at best approximately 8 to 10 percent of the variation in day and night returns for the S&P 500 stocks.

One can make other objections to Knuteson’s paper. At the same, we know of no good explanation of the returns pattern. If you do, let us know.